There is value in sharing operational asset data with 3rd parties such as the OEMs and the service providers of your assets but also with your peers in the industry. The manufacturers of equipment can improve/innovate and become digital solutions providers (moving up the vertical). Whilst the service providers can benefit from closer cooperation with the asset owners, who want to increasingly consult with suppliers and system integrators to uncover and leverage the latest available valve technology with enhanced functionality, such as remote operations monitoring and analysis, over archaic products (see ARC Advisory Group). This is to reduce and optimize the on-site time of valve services personnel.

In reality though, not many manufacturers nor maintenance service providers have coined on this opportunity. Sharing of data between industry peers is even less common.

When we take the valve manufacturer market there are more than 800 valve manufacturers (Resolute Research). Of these 800, only a handful have developed and marketed (remote) monitoring solutions for control valves:

1. Samson: SAM Valve Management

2. Masoneilan: ValVue

3. Azbil: Valstaff

4. Emerson: ValveLink

5. Flowserve: ValveSight

But these solutions are vendor, model and make dependent and in certain cases require data extraction methods that are generally not allowed in continuous and safety-critical processes. Independent solutions, utilizing the valve/actuator/positioner data available over Fieldbus/HART, such as Yokogawa’s PRM and Emerson’s AMS, have been adopted by some blue-chip companies but widespread usage is limited.

There are multiple reasons why OEMs and valve service providers are not very successful in this market, the main ones:

1. Limited coverage and integration complexity for the Asset Owner:

Any fluid or gas-based process uses a variety of different makes and models of control valves. Coverage of the existing OEM solutions for the whole site, even when only critical valves are considered, is limited. This results, when an asset owner wants to (continuously) monitor its population of control valves, in an integration that is complex (and costly).

2. Knowledge deficit of digital technologies:

The arrear in the knowledge of digital technologies, which would enable reliability/maintenance departments to shift to data-driven maintenance, amplifies the ‘resistance’ to change. This combined with the limited coverage OEMs provide shies away the target users.

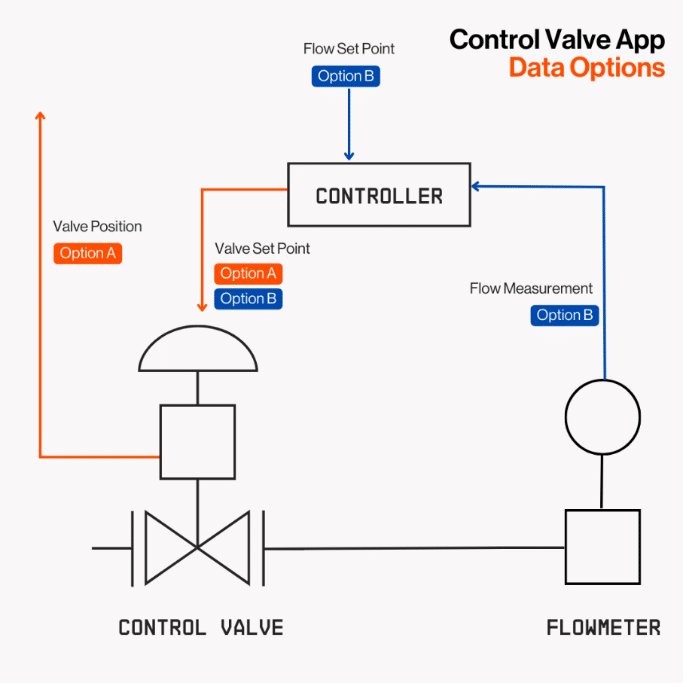

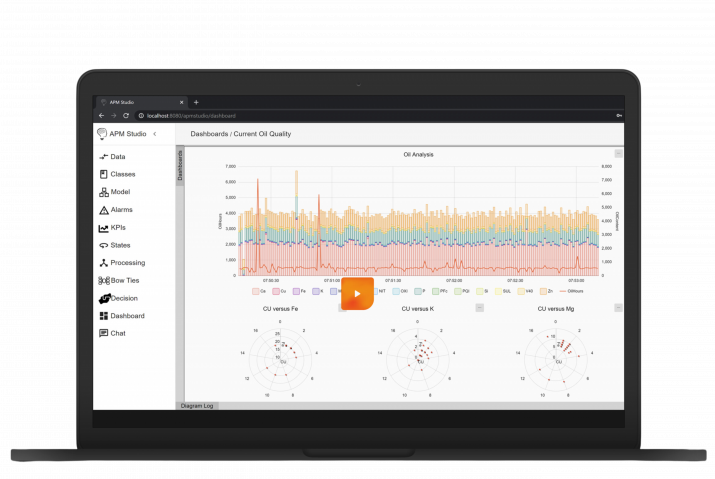

On top of this we witnessed, as an Asset Performance Management software provider, a change in the market from asset owners who wanted to create/develop and maintain bespoke APM solutions themselves to asset owners, today, that want a plug-and-play solution. This is one of the reasons why we released the Control Valve App. Make and model-independent and easily pluggable into existing data asset owners already collect:

With the successful launch in late 2022 and adoption in chemical, pharma, oil&gas, and energy industries by customers such as Yara, Evonik, LanXess and Vattenfall, we experienced first-hand the change in the market but also the trust and technical barriers industry deals with. We provide the Control Valve App as a SaaS solution, and also allow our customers to run the entire Control Valve App analytics stack themselves. Be it on-premise on their own hardware or in their own managed cloud environments.

We recognize the trust and technical barriers that the industry is dealing with and as such we embrace the frameworks the International Data Spaces Association is providing in the area of data sharing. More on this in the next blog.